Oracle Price

Price Oracles

Drake aggregates price feeds from multiple oracle networks to ensure accurate, reliable pricing across the platform.

Oracle Sources

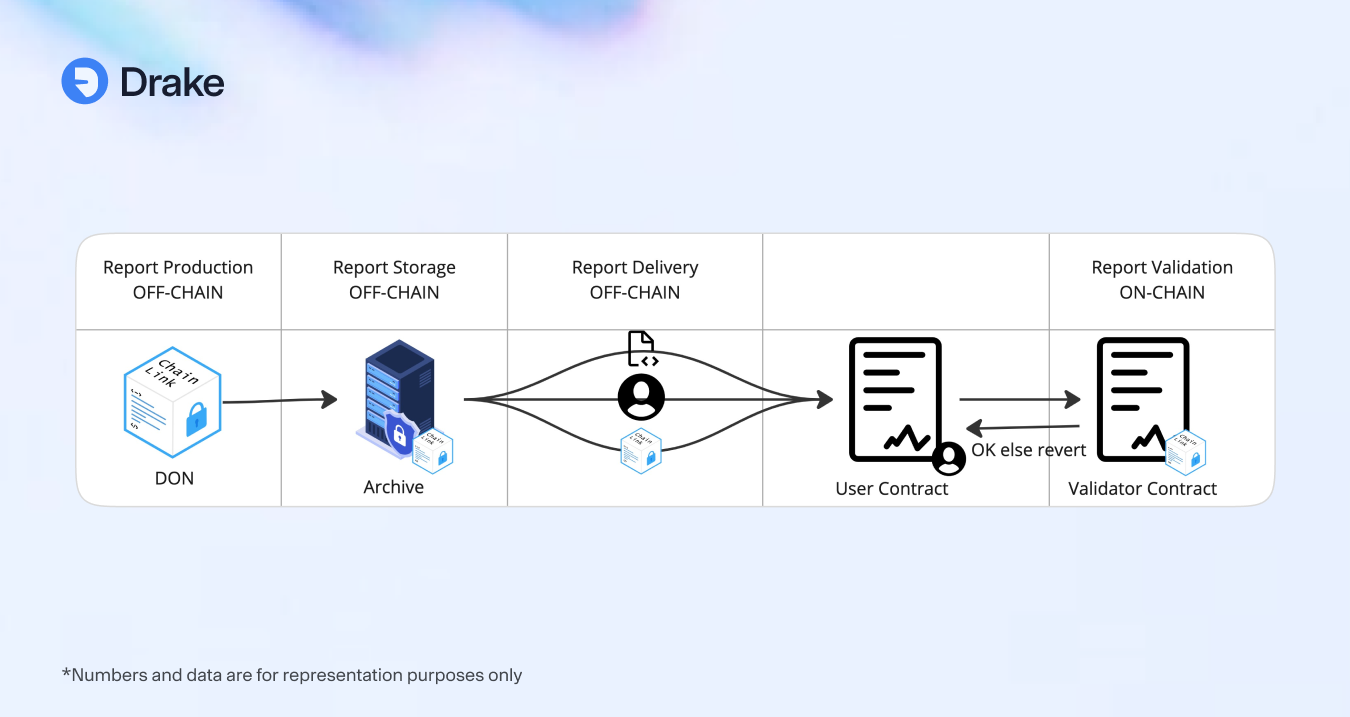

Chainlink Data Streams Low-latency price feeds with sub-second updates. Prices are stored off-chain in signed reports and verified on-chain through Chainlink's verification contract when needed for trades, liquidations, or position updates.

Pyth Network High-frequency price updates providing additional redundancy and sub-second market data.

Future Integrations: Redstone, Stork, and other providers for maximum redundancy.

Price Aggregation

Drake combines multiple oracle sources through a simple process:

Fetch latest prices from all active sources

Normalize to common format (decimal/scaling adjustments)

Filter stale data (prices older than 60 seconds)

Remove invalid or zero values

Calculate simple average of valid prices

Apply aggregated price across the protocol

Off-chain operators continuously monitor oracle networks, detect price changes, bundle signed price data, and submit on-chain updates.

Usage

Aggregated oracle prices power:

AMM vault pricing

Margin calculations

Liquidation triggers

Funding rate calculations

Position valuation

Key Benefits

Low Latency — Sub-second price updates ensure trades execute based on current market conditions, matching centralized exchange performance.

Frontrunning Prevention — Real-time data combined with cryptographic verification protects trades from manipulation common in decentralized environments.

Decentralized Reliability — Multiple independent oracle networks provide redundancy while maintaining transparency and avoiding single points of failure.

Drake's multi-oracle approach delivers centralized exchange speed with decentralized security and transparency.

reference: https://docs.chain.link/data-streams

Last updated