Funding Fee

Funding Fee Formula

Global funding fee APR

FundingFeeAPRbefore_clamp=abs(LongOI−ShortOI)FundingExponentFactor∗FundingConstantMultiplier/(LongOI+ShortOI+FundingConstantFactor∗TotalVaultBalance)Condition:(0<abs(LongOI−ShortOI)<MaxExposureLimit)

FundingFeeAPR=Clamp(FundingFeeAPRbefore_clamp,L,U)

APR on each side

abs(APRlong_position)=FundingFeeAPRabs(APRshort_position)=FundingFeeAPR

if LongOI>ShortOI:APRlong_position>=0,APRshort_position<=0else:APRlong_position<=0,APRshort_position>=0

i.e. when LongOI > ShortOI, long positions needs to pay funding fee (APR ≥ 0), short positions receives funding fee (APR ≤ 0)

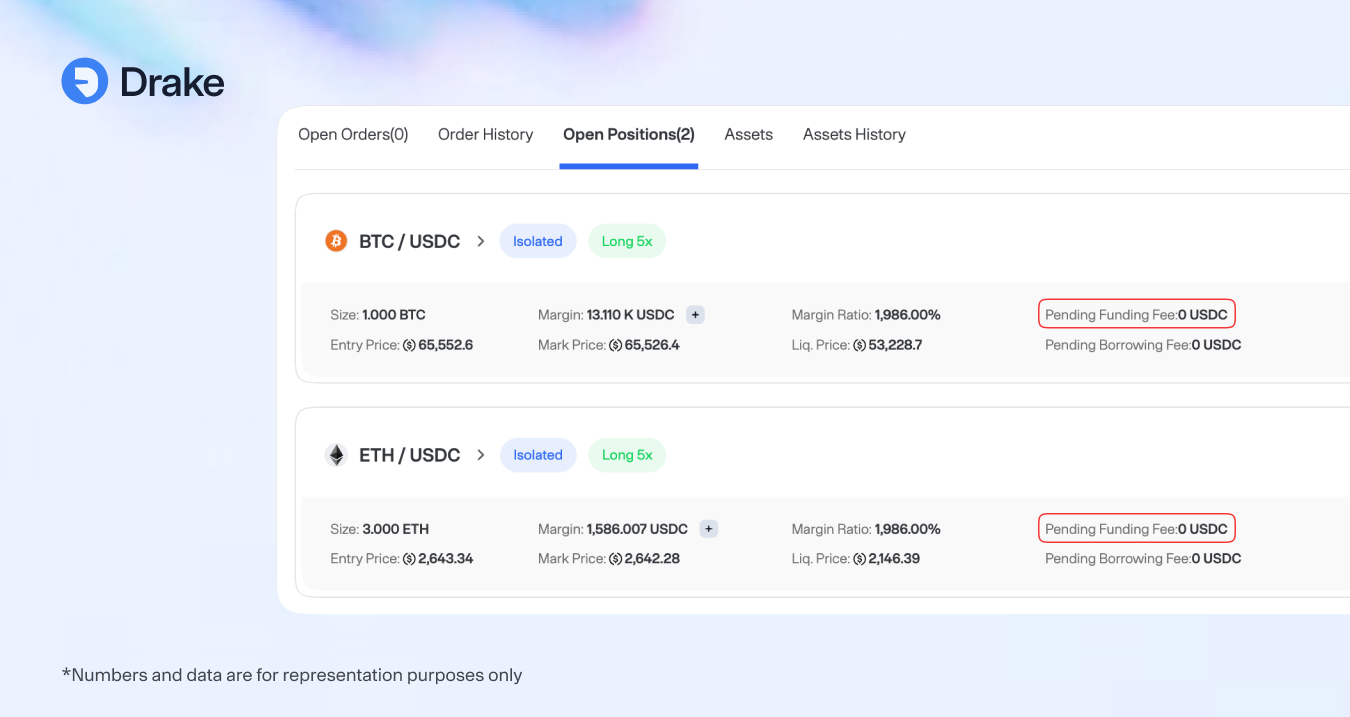

Final pending funding fee of an open position

funding fee=time_weighted_average APRlongORshort_position∗seconds_elasped /seconds_in_a_year ∗position_size ∗relative_price

note: time weighted average APR is the average APR value over the duration that this open position existed (since the last time that the funding fee was charged). Notice that the APR is basically a function of LongOI and ShortOI.

Funding Fee APR Clamp Range

Currency

Clamp / L APR

Clamp / U APR

FundingConstantMultiplier

FundingExponentFactor

FundingConstantFactor

Group 1: BTC, ETH

-150%

+150%

3

1

70%

Group 2: ADA, AVAX, BCH, DOT, EOS, ETC, FIL, LINK, LTC, TRX, XRP, ARB

-300%

+300%

5

1

20%

Group 3: Top(50)

-900%

+900%

10

1

10%