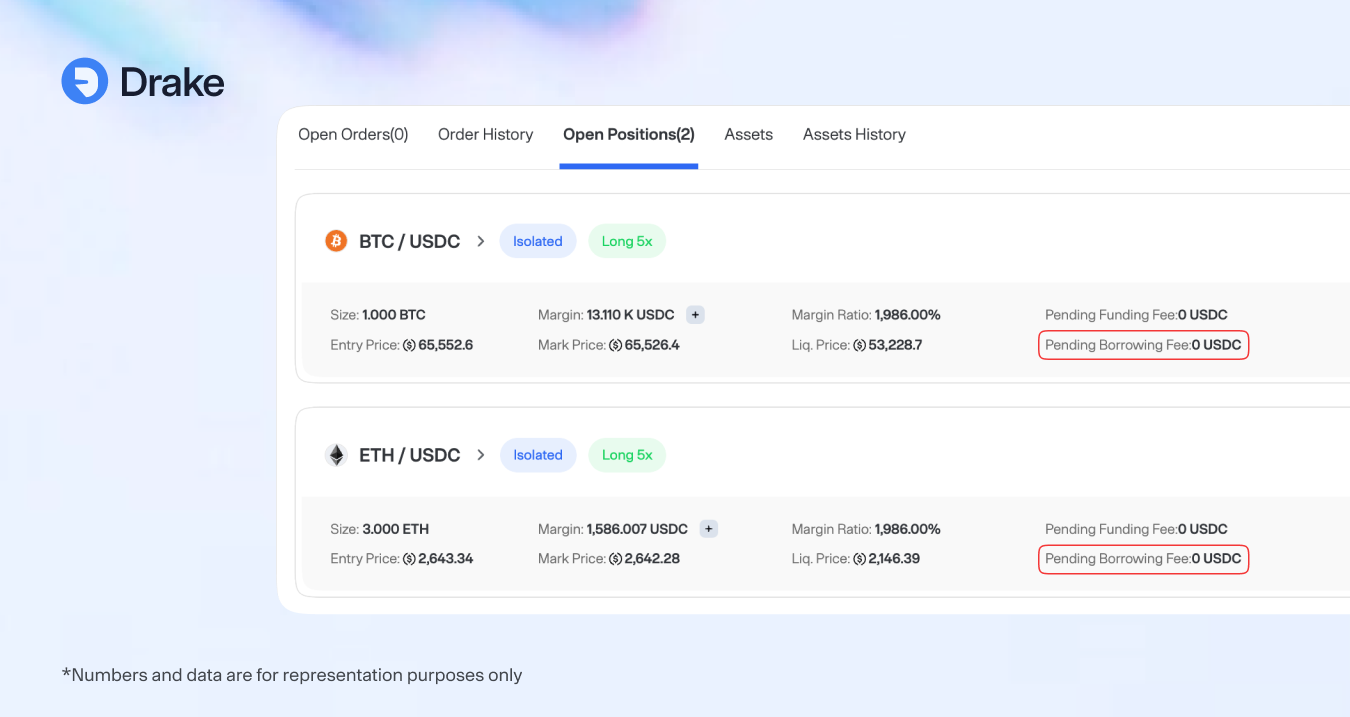

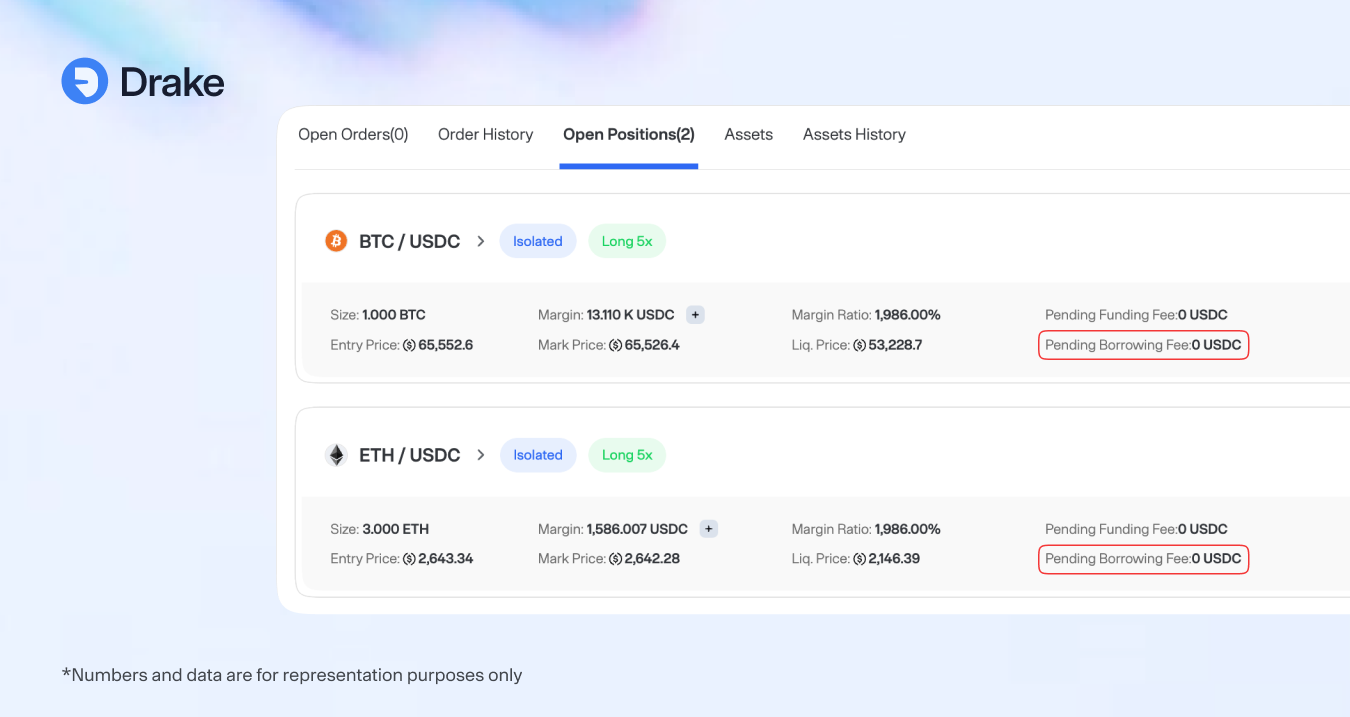

Borrowing Fee

Borrowing Fee Formula

Currency

VolFactorRange

OverBorrowingLimitFactor

UnderBorrowingConstantFactor

OverBorrowingConstantFactor

Clamp / L→APR

Clamp / U→APR

Weighted_Avg_Daily_ATR = (5 * Avg_Daily_ATR%_1_Days + 3 * Avg_Daily_ATR%_7_Days + 2 * Avg_Daily_ATR%_30_Days) / 10

VolFactorATR = Weighted_Avg_Daily_ATR / Daily_Close_price * 1000

VolFactor = VolFactorATR -> Clamp[1, 100]