Liquidity Vault

Vault Overview

Share Token Mechanics

Share Price = Total Vault Assets / Total Shares Outstanding

Total Assets = USDC + Unrealized PnL + Accrued FeesRevenue Streams

1. Trading Fees (60% to LPs)

2. Funding Payments (100% to LPs)

3. Borrowing Fees (100% to LPs)

4. Spread Capture (100% to LPs)

5. Counterparty PnL

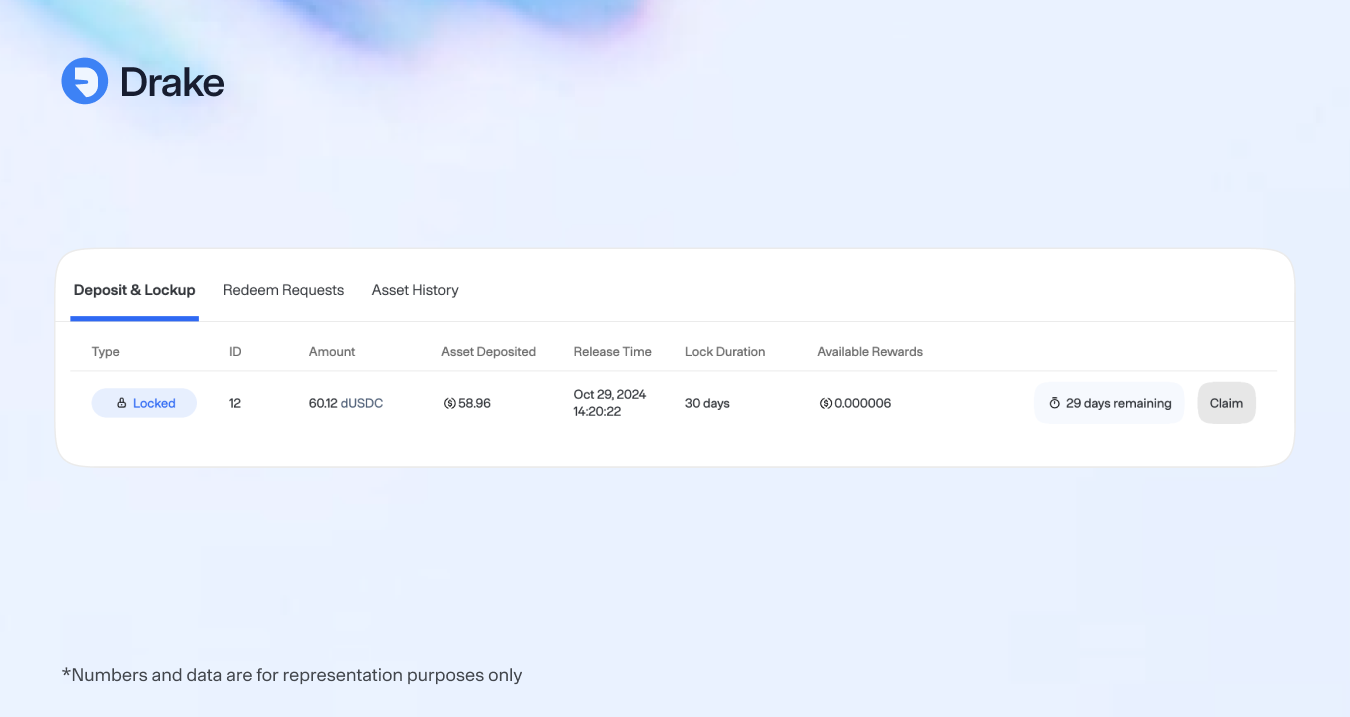

Withdrawal Process

Risk Factors

Last updated