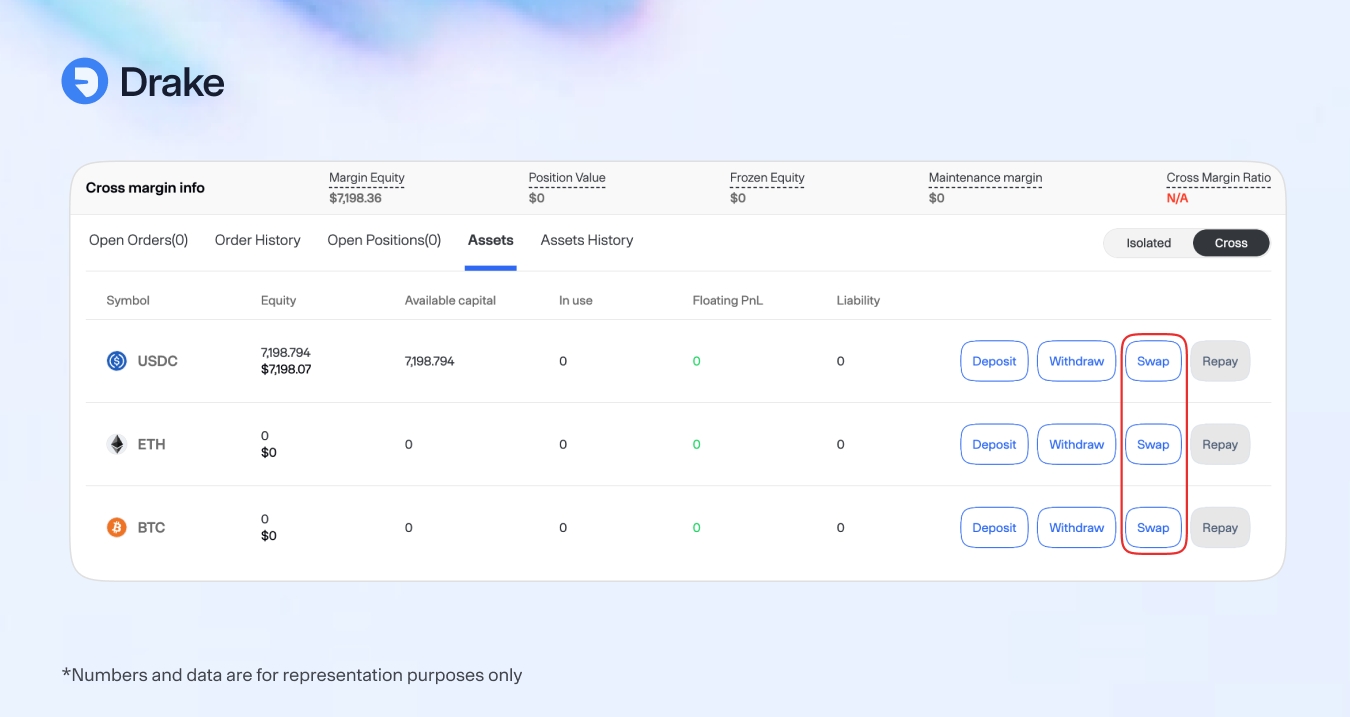

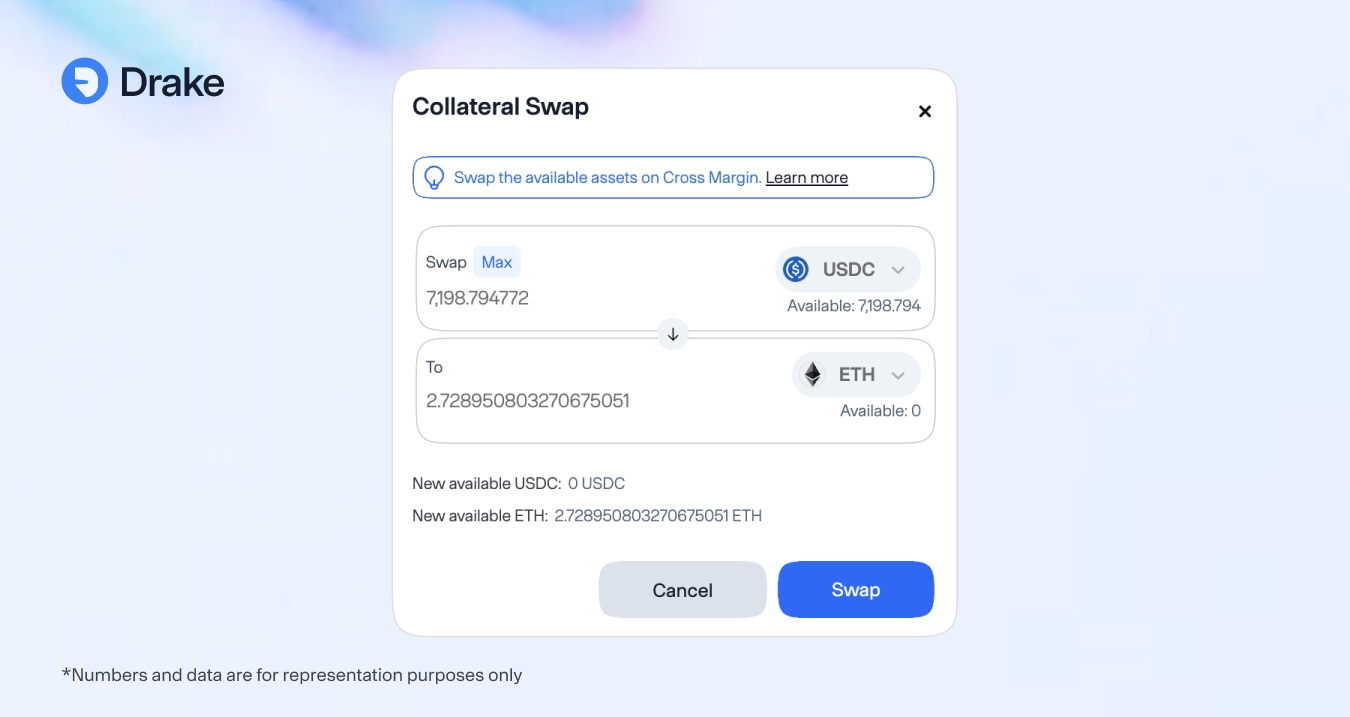

Collateral Swap

In cross-margin portfolios, Drake allows you to swap your available balance seamlessly. Currently, swap orders are routed through the Uniswap V3 and Aerodrome AMMs pool to ensure efficient execution. To protect your portfolio from the risk of liquidation, Drake enforces a safeguard that prevents any swap that would reduce your portfolio margin ratio below 200%. This ensures your positions remain secure while giving you the flexibility to manage your collateral.