Isolated Margin

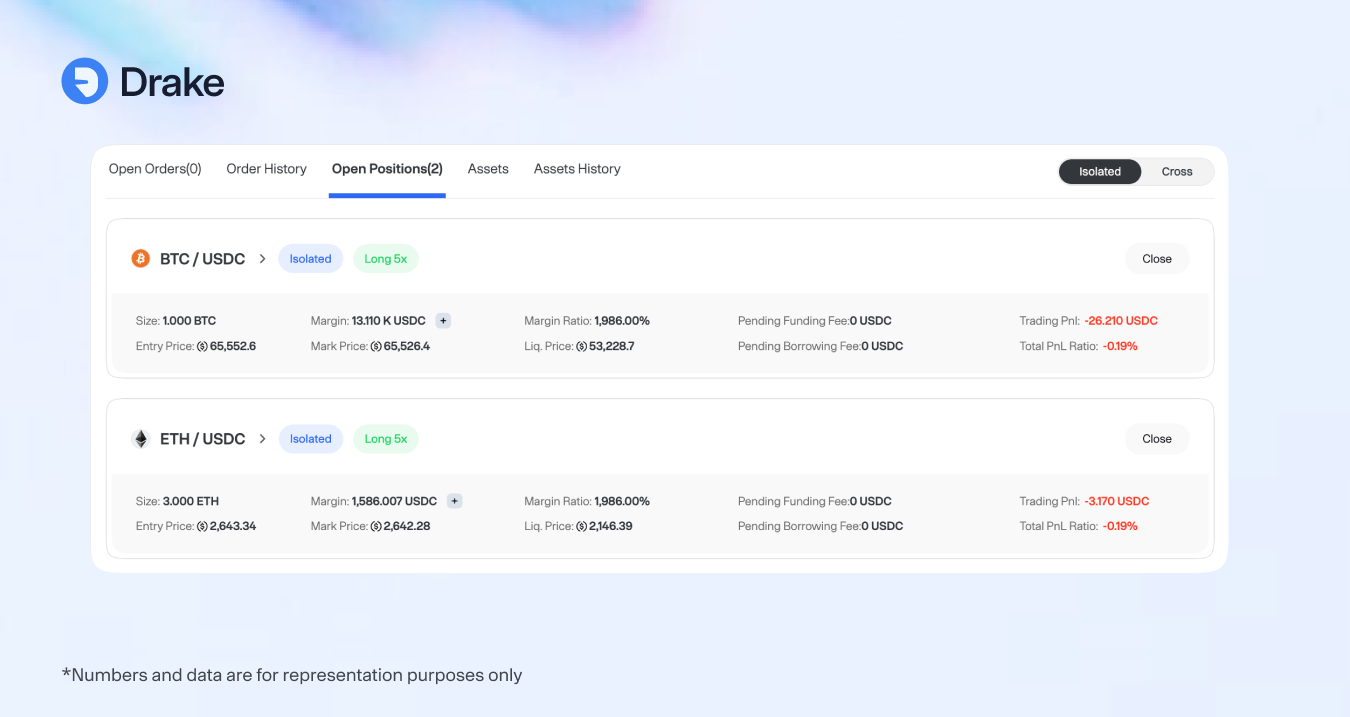

Isolated Margin Portfolio

An isolated margin account allocates dedicated USDC collateral to each individual position, completely separating it from other trades in your portfolio. Each position's margin can only support that specific trade.

Benefits

Risk Containment — Maximum loss is strictly limited to the margin allocated to each position.

Position Independence — Poor performance in one trade cannot threaten your other positions or account.

Clear Risk Metrics — Simple calculation of maximum downside for each trade.

Experimentation — Test new strategies with defined, limited risk exposure.

Margin Allocation

When opening an isolated margin position, you allocate specific USDC collateral that remains ring-fenced for that trade alone:

Position Margin = Allocated USDC (fixed at position opening)

Liquidation Risk = Limited to Position Margin only

Example: With $10,000 total USDC, you open a long BTC position with $5,000 isolated margin and a short ETH position with $3,000 isolated margin, leaving $2,000 free. If the BTC position liquidates, you lose only the $5,000 allocated to it. The ETH position and remaining $2,000 stay intact, leaving you with $5,000 total.

Important Considerations

Since each position requires separate margin allocation, capital efficiency is reduced compared to cross margin. Excess margin in profitable positions cannot support other trades, leading to lower overall leverage and potential opportunity costs.

Best Practices:

Allocate margin proportional to position risk Calculate maximum loss before entering each trade Keep adequate free collateral for new opportunities Consider cross margin for correlated positions

Last updated