Cross Margin

Cross Margin Portfolio

Cross Margin Portfolio

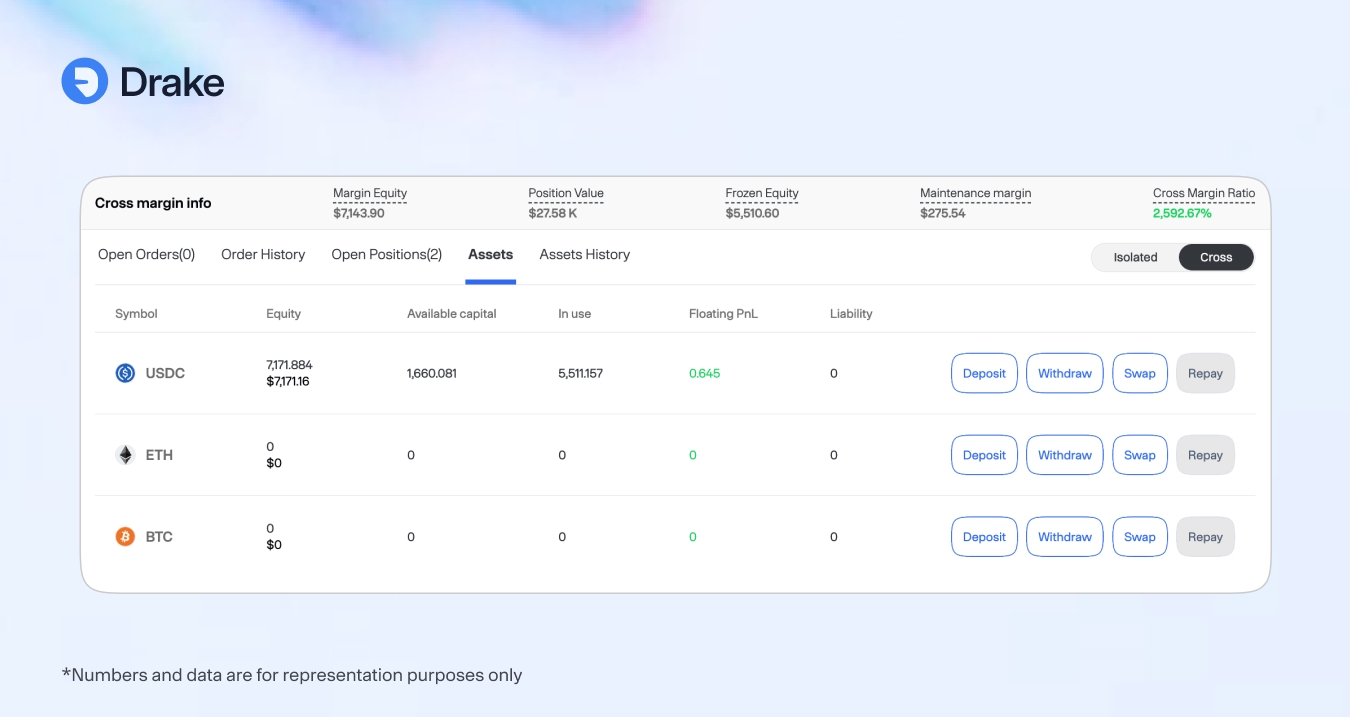

A cross margin account combines margin requirements across all your positions into a single pool. Any available margin can support any position in your portfolio.

Benefits

Capital Efficiency — Excess margin from one position can offset requirements for another, freeing up capital that would otherwise sit idle.

Reduced Liquidation Risk — Pooled margin across all positions decreases the chance of individual liquidations during volatile periods.

Simplified Management — Monitor one margin account instead of tracking multiple isolated positions.

Greater Leverage — Margin requirements are calculated on your net portfolio risk rather than individual positions.

Advanced Hedging — Efficiently deploy margin across different positions to implement complex risk management strategies.

Margin Calculation

Your portfolio health is determined by:

Portfolio Margin Ratio = (Adjusted Equity + Unrealized PnL) / Maintenance Margin

Adjusted Equity — Your collateral value after asset-specific haircuts:

Stablecoins (USDC, USDT): 0-5% haircut

Blue-chip crypto (WBTC, WETH): 10-15% haircut

Large-cap alts: 20-30% haircut

Mid/small-cap alts: 30-70% haircut

Unrealized PnL — Combined profit/loss across all open positions

Maintenance Margin — Minimum margin required to keep all positions open

Important Considerations

Since margin is shared across all positions, losses in one trade can affect margin available for others. This increases overall portfolio risk if not carefully managed.

Best Practices:

Monitor margin levels and total exposure closely

Use stop-loss orders to limit downside

Manage position sizes conservatively

Maintain adequate margin coverage to avoid liquidation

Last updated